The Ultimate Guide To Pacific Prime

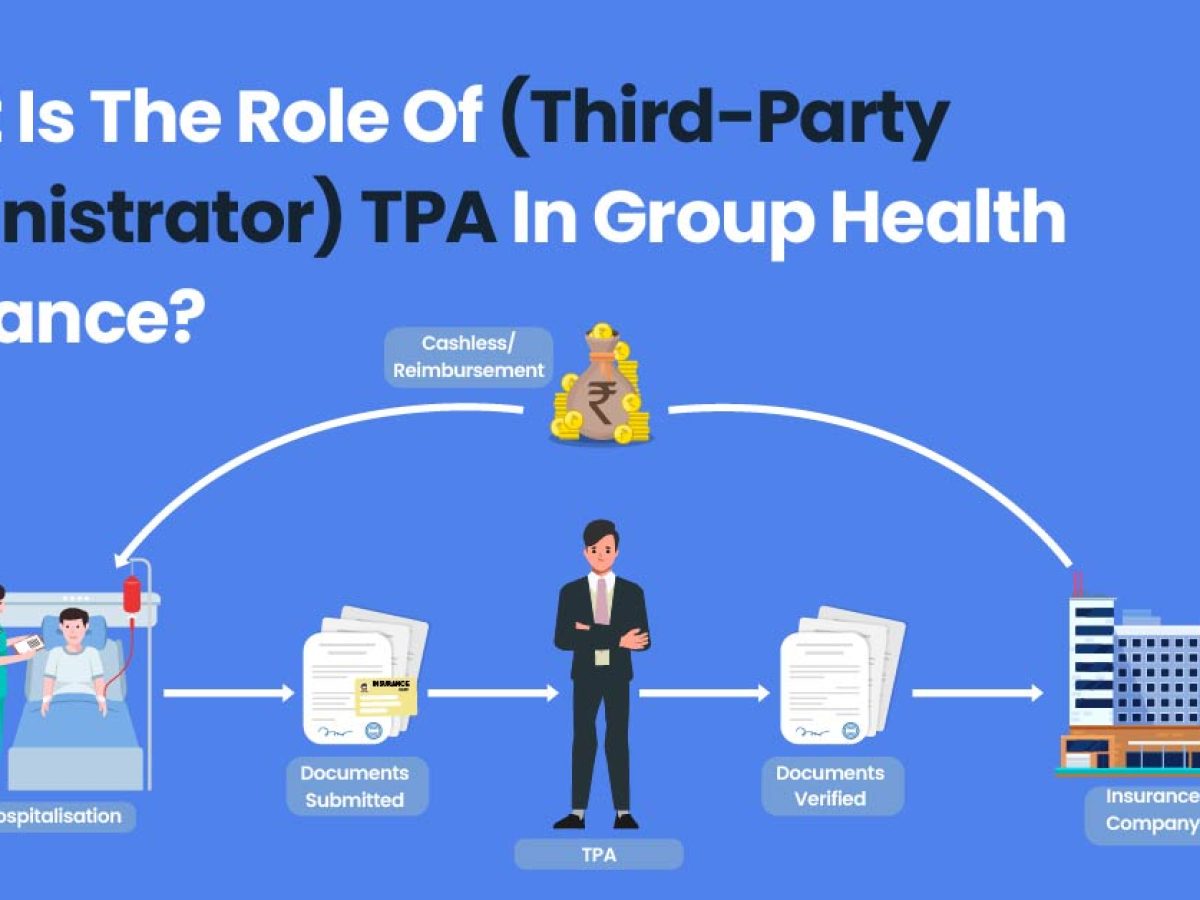

Insurance coverage also assists cover costs associated with obligation (lawful obligation) for damages or injury created to a third celebration. Insurance coverage is an agreement (plan) in which an insurance firm indemnifies another versus losses from particular contingencies or hazards. There are numerous kinds of insurance coverage. Life, wellness, house owners, and vehicle are among the most typical kinds of insurance policy.

Investopedia/ Daniel Fishel Several insurance coverage types are offered, and virtually any kind of individual or company can locate an insurance policy company happy to guarantee themfor a price. Usual individual insurance coverage plan kinds are automobile, health, house owners, and life insurance coverage. A lot of individuals in the United States have at least one of these kinds of insurance policy, and auto insurance is required by state regulation.

Pacific Prime Fundamentals Explained

Locating the rate that is ideal for you calls for some research. Optimums might be set per duration (e.g., yearly or policy term), per loss or injury, or over the life of the policy, also known as the lifetime optimum.

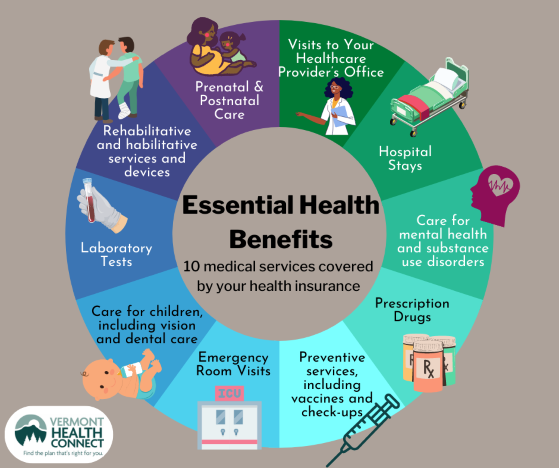

There are lots of different kinds of insurance policy. Health and wellness insurance aids covers routine and emergency clinical care costs, frequently with the alternative to include vision and dental services separately.

Nonetheless, numerous preventative solutions may be covered for free before these are fulfilled. Health insurance policy may be bought from an insurer, an insurance policy agent, the federal Health and wellness Insurance coverage Industry, provided by an employer, or government Medicare and Medicaid insurance coverage. The federal government no much longer needs Americans to have medical insurance, however in some states, such as The golden state, you may pay a tax fine if you do not have insurance.

The Ultimate Guide To Pacific Prime

As opposed to paying out of pocket for automobile mishaps and damage, people pay yearly costs to an automobile insurance provider. The firm after that pays all or many of the covered expenses related to a vehicle mishap or various other car damages. If you have actually a leased lorry or obtained cash to acquire a cars and truck, your loan provider or renting dealership will likely require you to lug vehicle insurance policy.

A life insurance coverage plan warranties that the insurance company pays a sum of cash to your beneficiaries (such as a partner or youngsters) if you die. There are 2 main types of life insurance.

Irreversible life insurance policy covers your whole life as long as you continue paying the costs. Traveling insurance coverage covers the costs and losses connected with taking a trip, including trip terminations or delays, coverage for emergency situation healthcare, injuries and evacuations, harmed baggage, rental autos, and rental homes. Also some of the best traveling insurance policy firms do not cover cancellations or hold-ups due to weather, terrorism, or a pandemic. Insurance coverage is a way to handle your financial dangers. When you get insurance policy, you buy security versus unexpected monetary losses. The insurance firm pays you or somebody you select if something negative occurs. If you have no insurance coverage and a mishap takes place, you might be accountable for all relevant costs.

The Only Guide for Pacific Prime

Although there are lots of insurance plan kinds, several of one of the most typical are life, health and wellness, home owners, and car. The appropriate kind of insurance policy for you will certainly rely on your objectives and financial situation.

Have you ever had a minute while looking at your insurance plan or shopping for insurance when you've thought, "What is insurance coverage? Insurance policy can be a mystical and puzzling thing. How does insurance policy work?

Enduring a loss without insurance can put you in a hard economic situation. Insurance coverage is a vital financial tool.

Pacific Prime Fundamentals Explained

And sometimes, like car insurance policy and workers' compensation, you may be required by law to have insurance policy in order to protect others - maternity insurance for expats. Find out about ourInsurance options Insurance is basically a big rainy day fund shared by many individuals (called policyholders) and taken care of by an insurance coverage provider. The insurance provider makes use of cash gathered (called premium) from its insurance policy holders and other investments to pay for its look at this site procedures and to accomplish its promise to policyholders when they submit a claim

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)